Why Emerging Markets Now?

Emerging Markets Evolution

Emerging market economies offer strong domestically driven growth as well as a growing share of world exports backed by economies of scale and a large talent pool. According to Economist Intelligence, in the longer term, many emerging economies could expand more rapidly (c. 2-3 per cent. per year in the period 2022- 2050, in absolute real GDP terms) than their developed counterparts (with growth in the US and much of western Europe expected to average only about 1-2 per cent.).1 There is scope to benefit from this growth differential and potentially earn higher excess returns from the market through superior security selection. The key factors driving growth in Emerging Markets include:

Favourable Demographics, Rising Income Levels, and Increasing Consumption

Demographics are likely to play a significant role for emerging markets, driving the overall corporate earnings growth and equity markets as a result. The favourable demographics – young populations with a median age of 34 compared to 41 for developed regions – and rising income levels should allow domestic consumption to flourish even further, with demand for discretionary goods, travel & leisure, financial and healthcare services on the rise. The burgeoning middle-class population, which already represents a third of global demand, should also shape major global trends driving growth within emerging markets.

Stronger Macro Fundamentals, Rising Investments, and Enhanced Productivity

Over the last two decades, many emerging markets have strengthened their macroeconomic fundamentals by bringing in reforms and implementing efficient policies. A majority of the emerging market central banks now set policy rates based on respective target inflation ranges. In addition, emerging market governments have been keeping public finances in check, guided by their fiscal consolidation roadmap.

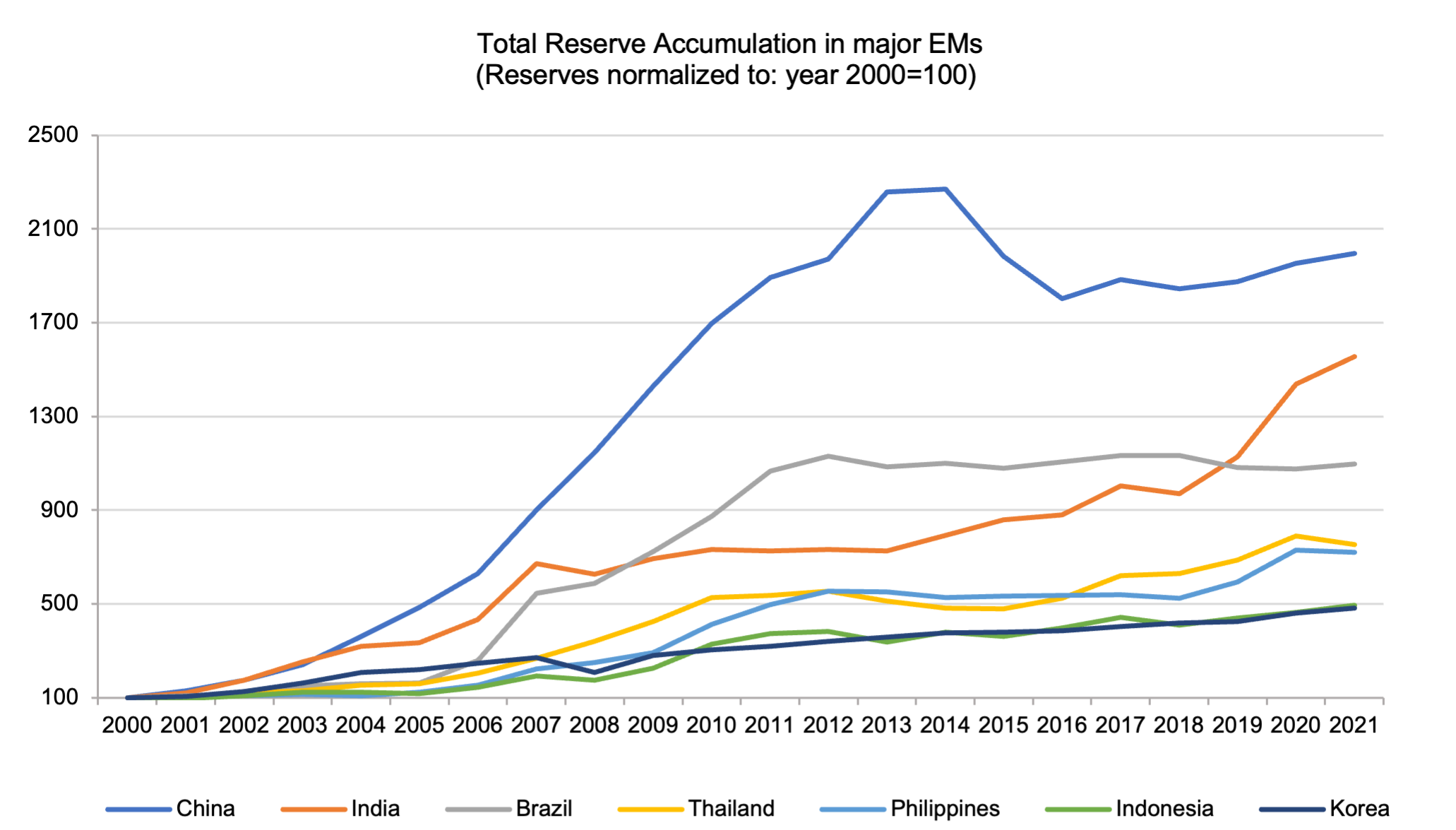

Emerging market countries have more than doubled their per capita incomes on average over the last two decades. Strong external balances and a healthier banking sector – post the financial crises of the 1990s – has helped emerging market economies accumulate reserves at a steady pace, thereby providing greater macroeconomic stability to their currencies. A significant portion of household financial savings has been used domestically, reducing the need for foreign borrowing.

As compared to developed economies, the growth differential has tilted in favour of emerging markets, which are benefitting from several secular tailwinds. Many governments in developing countries are more focused on developing physical infrastructure. These countries are experiencing rapid digitalisation of services, supported by increasing internet penetration and formalisation of economic activity. Improving technological prowess and digitalisation should provide higher returns on investments for businesses and boost productivity, even when the demographic advantage has peaked out in years to come. Additionally, the Investment Manager expects financialisaton as a trend to accelerate. With increasing financial inclusion and growing financial literacy, saving patterns are expected to see a gradual but structural shift towards financial products like equities.

Diverse Corporate Universe, Attractive Relative Valuations, and a Cyclical Rebound with Respect to the Developed Markets

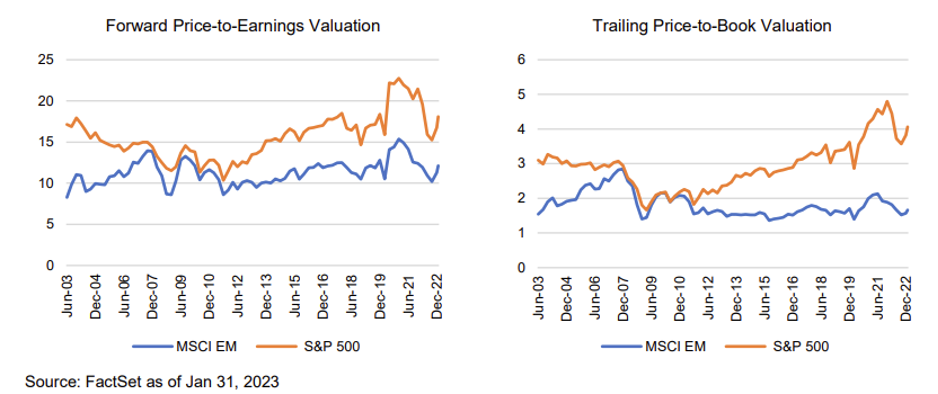

As of 2022, emerging market equities represented only 11 per cent. of MSCI global equity market capitalisation despite their economies comprising over 40 per cent. of global GDP. Also, as per estimates from broker reports, the average global investors’ allocation to emerging markets is approximately 6-8 per cent. of total equities2, highlighting it as an under-allocated asset class. Emerging markets and emerging market companies are generally less well-researched and often offer attractive valuation inefficiencies which an active manager can exploit, thereby making them potentially rewarding investments, especially when they are trading at attractive valuations. Immediately after the global financial crisis in 2008, emerging market countries were left reeling under higher inflation and low employment growth, along with weaker macro fundamentals, which resulted in years of equity market underperformance relative to the US. Emerging market countries over recent years appear to have improved their economic fundamentals leading to a cyclical economic rebound, similar to the one seen at the start of the century. This is further supported by attractive emerging market equity valuations.

As of 2022, emerging market equities represented only 11 per cent. of MSCI global equity market capitalisation despite their economies comprising over 40 per cent. of global GDP. Also, as per estimates from broker reports, the average global investors’ allocation to emerging markets is approximately 6-8 per cent. of total equities2, highlighting it as an under-allocated asset class. Emerging markets and emerging market companies are generally less well-researched and often offer attractive valuation inefficiencies which an active manager can exploit, thereby making them potentially rewarding investments, especially when they are trading at attractive valuations. Immediately after the global financial crisis in 2008, emerging market countries were left reeling under higher inflation and low employment growth, along with weaker macro fundamentals, which resulted in years of equity market underperformance relative to the US. Emerging market countries over recent years appear to have improved their economic fundamentals leading to a cyclical economic rebound, similar to the one seen at the start of the century. This is further supported by attractive emerging market equity valuations.

Emerging markets and emerging market companies are generally less well-researched and often offer attractive valuation inefficiencies which an active manager can exploit, thereby making them potentially rewarding investments.

1 Economist Intelligence (12 October 2022), “Emerging markets: will the economic catch-up continue?”. 2 Morgan Stanley (2021), “Emerging Market Allocations: How Much to Own?”.

References to indices, benchmarks, or other measures of relative market performance over a specified period of time are provided for your information only and do not imply that the portfolio will achieve similar results. The index composition may not reflect the manner in which a portfolio is constructed. While the manager seeks to design a portfolio which reflects appropriate risk and return features, portfolio characteristics may deviate from those of the benchmark.

The forecasts do not take into account the specific investment objectives, restrictions, tax and financial situation or other needs of any specific client. Actual data will vary and may not be reflected here. The forecasts are subject to high levels of uncertainty that may affect actual performance. Accordingly, these forecasts should be viewed as merely representative of a broad range of possible outcomes. These forecasts are estimated, based on assumptions, and are subject to significant revision and may change materially as economic and market conditions change. WO has no obligation to provide updates or changes to these forecasts. Emerging markets securities may be less liquid and more volatile and are subject to a number of additional risks, including but not limited to currency fluctuations and political instability.References to indices, benchmarks, or other measures of relative market performance over a specified period of time are provided for your information only and do not imply that the portfolio will achieve similar results. The index composition may not reflect the manner in which a portfolio is constructed. While the manager seeks to design a portfolio which reflects appropriate risk and return features, portfolio characteristics may deviate from those of the benchmark.

The forecasts do not take into account the specific investment objectives, restrictions, tax and financial situation or other needs of any specific client. Actual data will vary and may not be reflected here. The forecasts are subject to high levels of uncertainty that may affect actual performance. Accordingly, these forecasts should be viewed as merely representative of a broad range of possible outcomes. These forecasts are estimated, based on assumptions, and are subject to significant revision and may change materially as economic and market conditions change. WO has no obligation to provide updates or changes to these forecasts. Emerging markets securities may be less liquid and more volatile and are subject to a number of additional risks, including but not limited to currency fluctuations and political instability.